Interests Going Up! Is this the crash of the Miami housing bubble? Are prices going to go down?

Now looking at the history of the housing market, yes the Miami real estate housing is at its peak. But is the market is ready to burst, I am going to break that down for you.

Miami Real Estate Home Value vs Local Earnings Data (Video)

Is 2022, A New Version of 2008 Real Estate Crisis?

It is all a matter of perception, the details that lead to financial & housing crisis 2008 are different to the effects of closing down the economy, during 2020-2022 . The economy goes through different phases, and fundamentals well applied result in more balanced markets.

Back in 2008, loose lending standards were a huge contributor to the 2008 market crash. Today, it is the excessive quantative easing (QE) or excessive money printing, the inedited low-record interests and the government incentives. Different measures, same results?

We could speculate, on the mechanism the Feds used during both crisis and its possible consequences. Today, the real effect or outcome of the Feds buying mortgage securities during the last two years remain yet to be seen.

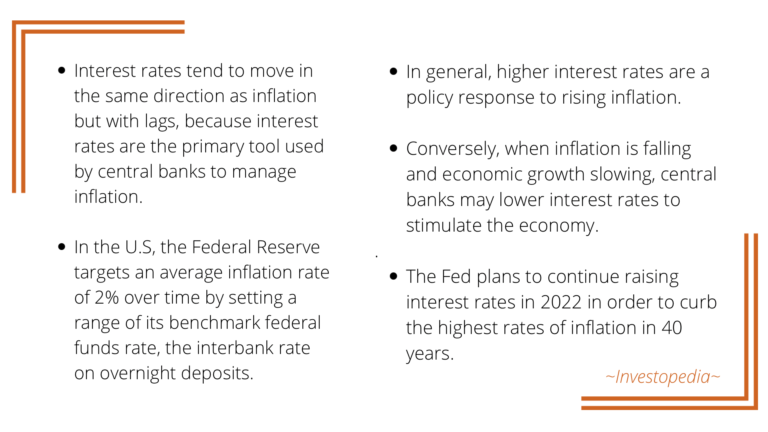

Most expert forecast were skeptics on the Feds slow method to confront inflation. But now, that the Feds increased 0.75 in interest rates, most forecast need to be reframed .

What to Expect with Higher Interests in the Housing Market

Higher Interest Effects

Higher interest rate turns off demand. The higher interest results in higher montly payment. Which then leads potential buyers’ do not have the income to meet the monthly payment, as required for a loan approval.

Inflation increases the price of goods and assets, and rising interests increase the cost of loans. In the meantime, wages or income remain the same.

When the Feds say they want to decrease demand to curb inflation, it just translate into people inhability to afford buying a house. The lesser number of qualified homebuyers drops the demand and leads to housing prices decline. At the end the market reaches a better balance.

The problem affects the entire economy. When demand drops, all businesses get affected leading to an increase of lay-offs. Unemployment rate spikes, as well as, people defaulting on their loans. It is a domino effect where many suffer tremendous losses.

Lower Demand Effects

When purchasing power gets down, demand slows down . The direct effect results in lesser people qualifying for mortgage loans. Higher interest rate means higher monthly payments and most people income has barely increased, earnings need to pair inflation rate, and that is a wishfull thought! Therefore loan approvals decrease.

Slow business growth is the indirect effect of higher interest. Businesses’ line of credits and loans become too expensive. Lay-off and people losing their jobs result in an increase of homes for sale. The market can very rapidy change from a sellers market to a buyers market. And, homerowners are then forced to reduce their asking price.

There are many factors evaluated within the economy, the process could be a fast or a long process. To simplify, if the growth is generated by goods and services, the recovery is much faster. If we get stuck with financial gimmicks to keep the economy from a severe recesion then the process could be much longer.

Reality is none of the effects of these facts are on our control, our job is to take decisions understanding our gains and our losses as we build our wealth.

What to expect for the Miami Housing Market

Miami and the entire US housing market is already feeling the effects of this new policy. There are important facts that make the Miami real estate in a much better position to confront this new crisis.

Every situation has a gain and a loss, it is important to understand it. Here are a few of Miami housing market biggest gains , during the last two years:

Miami-Dade Housing Gains

- Miami-Dade is among the top 10 cities that benefitted from US internal migration.

- Miami-Dade sold 69,184 home units since 2020-April 2022. Cash buyers represented 40% of homes sales during the same period. Investment firms bought 21,209 during the same period. The number of debt-free homeowners is of 47, 975. This makes Miami a much stronger housing market. (Redfin: Data Source)

- The number of new construction Condos expecting to deliver during 2023-24 is very low. As well as the number of new single-family homes. The number of new construction inventory is not oversized.

- The number of Corporations that have relocated to Miami, make job availability a better place and better housing market.

- Miami real estate is a strong investment market with many opportunities for international buyers whose economies are much worse than ours.

Miami-Dade Single-Family Homes Cash Purchases

Miami-Dade Condo Cash Purchases

- $1,000,000+ range had : 51% cash buyers

- $500,000 ~ $900,000 range had : 21% cash buyers

- under $500,000 range had : 18% cash buyers

- $1,000,000+ range had: 82% cash buyers

- $500,000 ~ $900,000 range had: 21% cash buyers

- Under $500,000 range had: 52% cash buyers

Hoping this information helps you understand how these policies affect the housing market. Today, the Miami real estate market is in a much better place, even with the storm in front of us. If you would like any inquiry about the Miami real estate market and your housing needs we are always here to help you. Remember “Much of our successes get lost for the lack of a little more”.