Florida Housing Market First Signs of Shifting. These are good news for florida buyers.

The housing market is starting to feel some inventory changes throughout the state. For the last two years, moving to Florida became a trend, partially motivated by the record-low interest rates.

The housing demand sky-rocketed causing a huge drop in the inventory of homes for sale and a record-high home appreciation.

The market knew the trend was temporary, it was a window of opportunnity for many. Mainly, because it was artificially induced by the economic measures taken by the Feds to confront the pandemic. It was not a conventional supply and demand dinamic.

Consequences of Policy Making

Sellers were receiving large numbers of multiple offers driving home prices much higher than asking prices. Both metro and surburban areas had a hard time. The lack of housing drove buyers completely frustrated losing bids after bids.

This phenomenon drove assest prices to an all time high. Home buyers could no longer afford to buy at those prices. Rental became the only choice. By the 4th quarter of 2021, rents went so high that today, a large portion of families cannot afford to pay rent anymore.

In Miami, rents increased over 45%, when salary and compensation cost have only increased 4.3 percent by March 2022

Now, after three month since the Feds started to increase interest , the housing market is starting to feel it in specific areas.

Understanding Housing Market is a Cyclical Market

Before, you go into the data, it is important to understand Florida is a cyclical housing market. In cyclical markets, demand and offer can show steeper appreciation and steeper depreciation. On the other hand, salary and compensations increases tend to remain extremely low.

In the US there are other similar markets, and there are also market that show a more balance flow.

Markets with more even appreciation/depreciation tend to be the best for steady income properties, where cyclical markets as Florida tend to be more longterm investment or for opportunistics investors.

The housing market is very tied to the financial system mainly because 75% of homes sales have a mortagage loan. Therefore, the value of homes always have a direct impact to Feds policy changes in the financial sector.

The Feds Policies Consequences on the Housing Market

When the Feds lowered the interests and started to buy mortgage backed securities it incentivized a massive buyers demand and housing prices skyrocketed.

But now the Feds are increasing interest and they are back to “reverse repo” Which means mortgage loan interests go higher, and they stop buying mortgage back securities .

Implementing these policies makes it much harder for people to get a mortgage loan. Therefore, it creates a drop in demand and a housing price collapse.

Looking at the number of houses for sale is an important indicator for a market shift. As you can see some areas, in florida, are already starting to feel how the inventory of homes for sale is increasing.

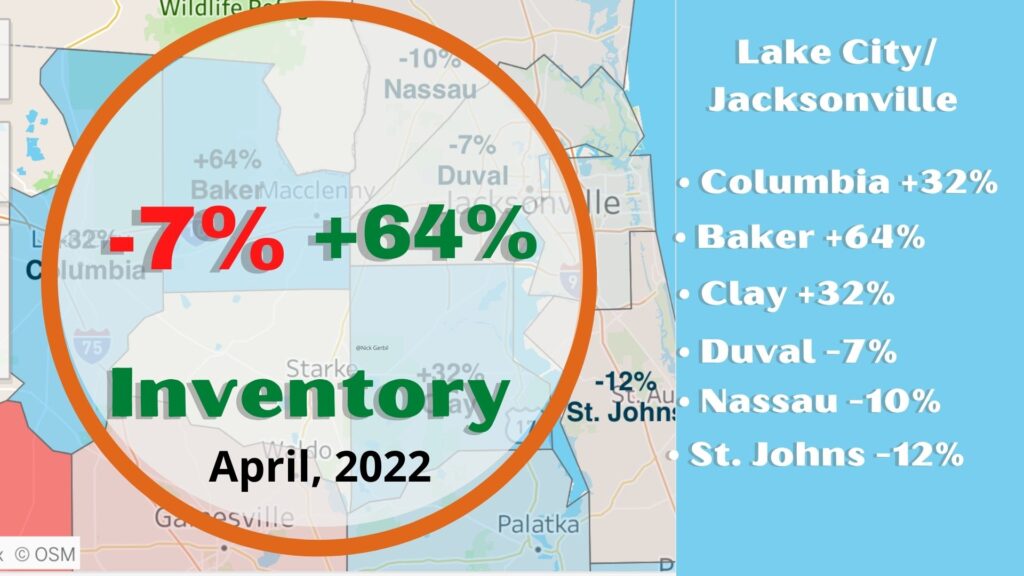

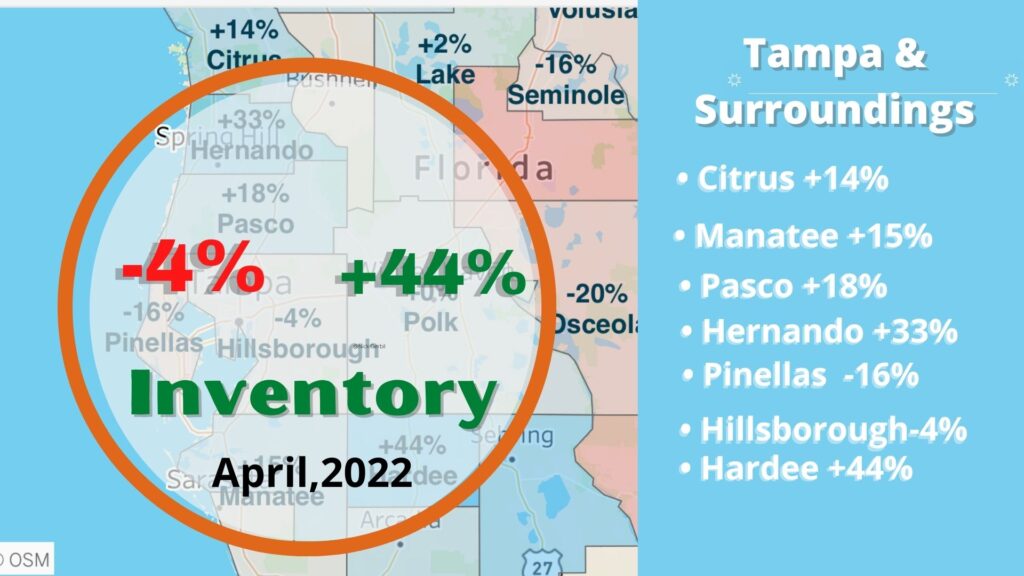

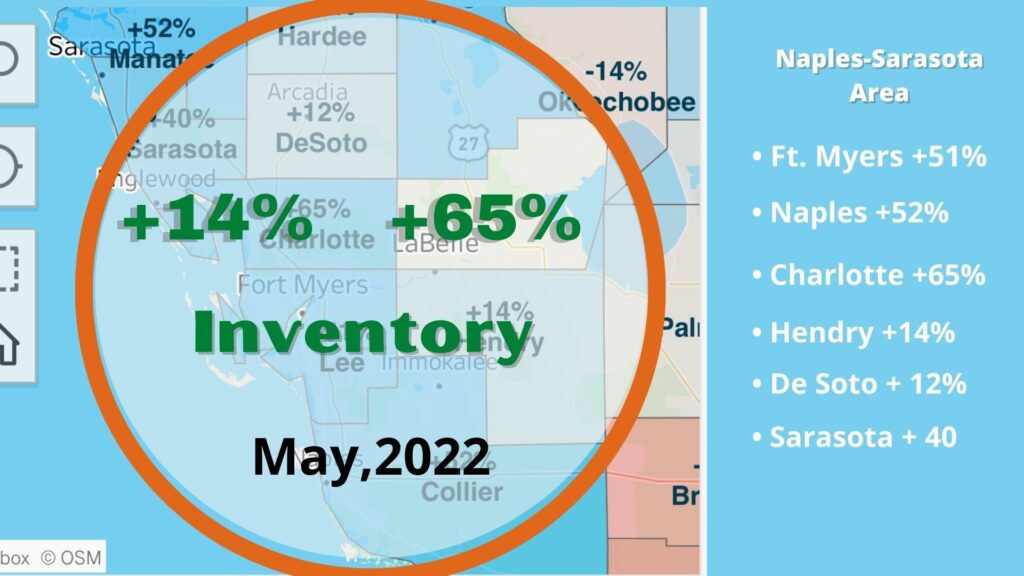

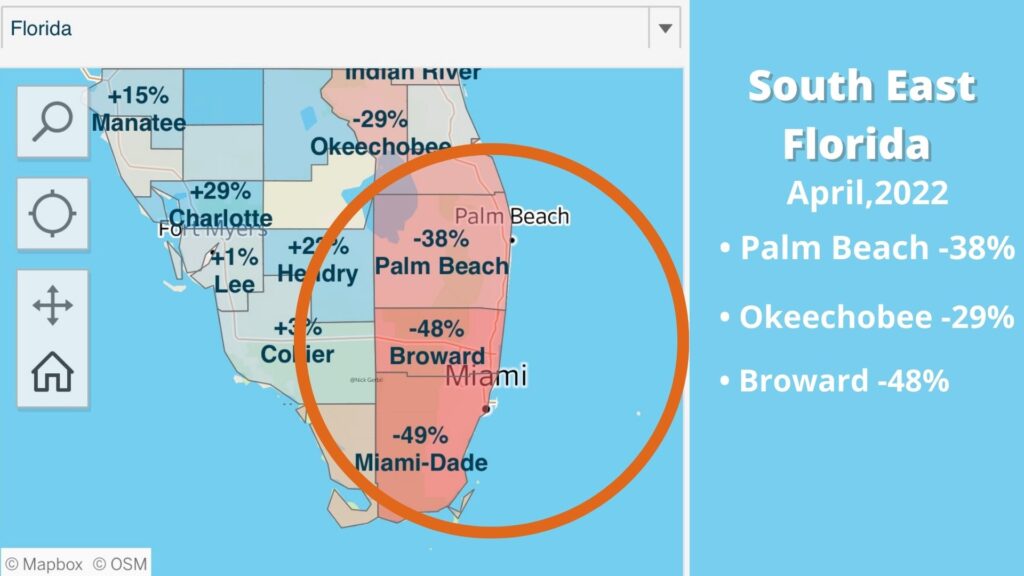

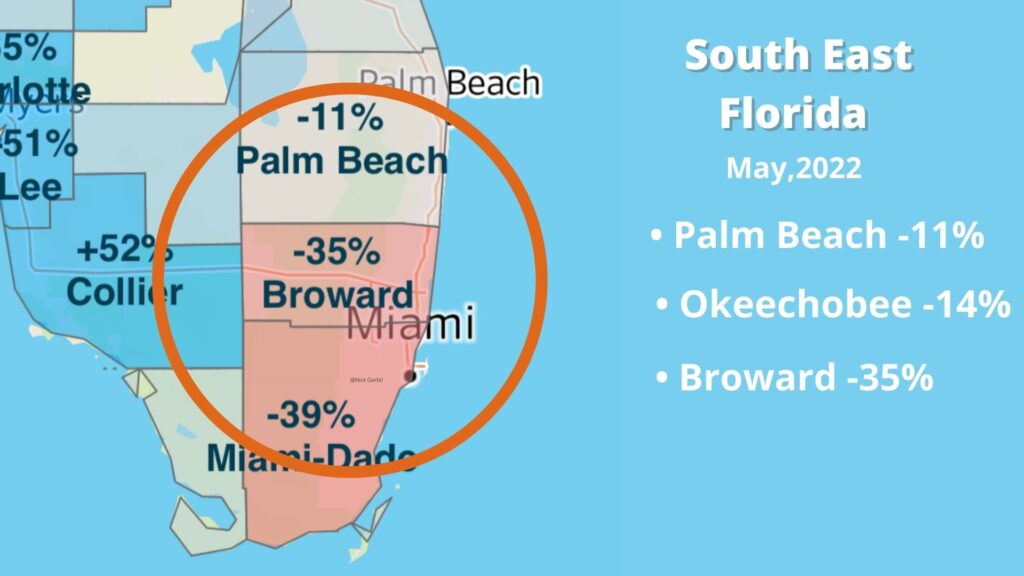

Today, I am sharing Realtor.com Inventory Increase/Decrease by County YoY, where you can see how inventory is increasing in most suburban areas. You can also see how some key metro areas in Florida are showing smaller negative numbers. These figures are average percentages of the county, you will have many zip codes included with different ratios from within. But looking it by county will give you the broad trend and behavior of the market.

Which Florida Counties are Showing the Highest Inventory (video)

Florida Housing Market First Signs of Shifting

As you can see, all these areas are showing big changes on the inventory homes for sale. From April’s inventory to May’s inventory there is a shift across the state.

In Jacksonville, the Duval area went from -7% Increase/Decrease inventory YoY to +4% . While Baker County went from +64% to 227%. Hillsborough has gone from -4% to +36%, in the Tampa area. Sarasota has gone from -14% to +40% while Naples has gone from +3% to +52%. And even Palm Beach on South East Florida has gone from -38% to -11%, according to Realtor.com Increase/Decrease inventory YoY.

I submitted several examples covering the entire state so you can see the trend. you can also go to the Realtor.com and do your own research

Jacksonville,St. John to Columbia Areas

Tampa Area & Surrounding Areas

Naples, Ft. Myers & Sarasota Areas

South East Florida

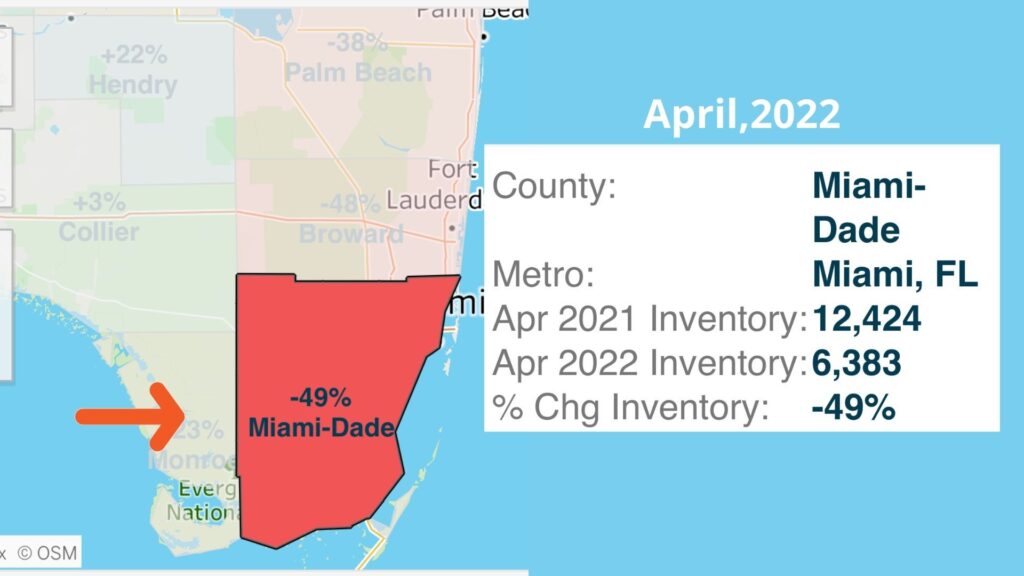

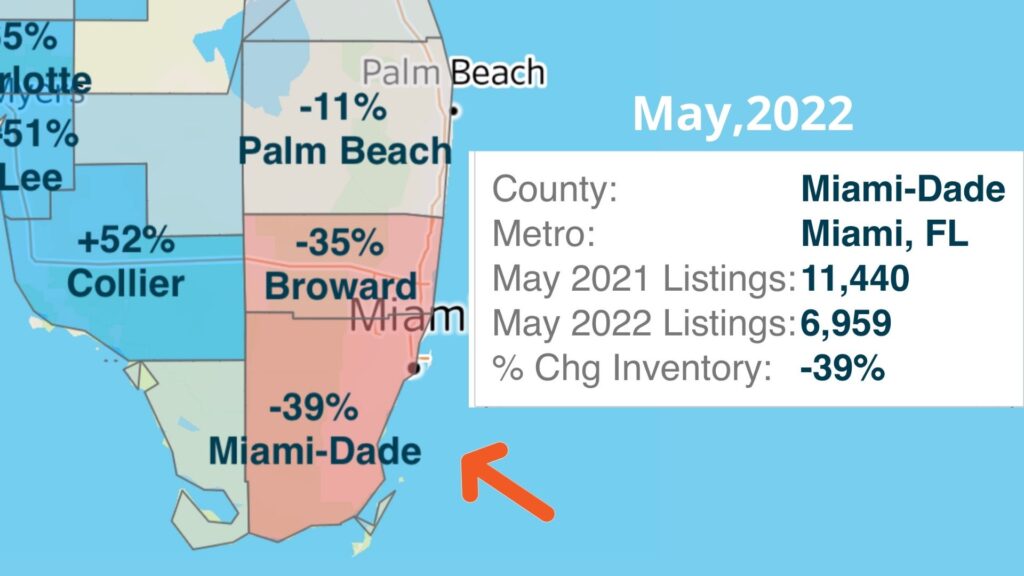

Miami-Dade County

South East Florida Housing Inventory

The Palm, Broward and Miami-Dade counties have a much different time line than the rest of Florida. The inventory scarcity remains too high.

Miami-Dade has very little new developments coming into the market any time soon, as I previously explained most new development to be delivered 22/23 have sold out.

Now even though, these three counties showed negative inventory. Palm Beach was at -38%, Broward at -48%, and Miami-County at -49%. Now during the month of May , Palm Beach had a -11% inventory which means 28% worth of inventory hit the market for sale from April to end of May. Broward is showing a -35% which means an 11% increase of inventory. And Miami-Dade is showing a -39% which is a 21% of more homes for sale.

Across the country there are signs of the housing market starting to slowdown, and as you saw above, some cities in Florida are already showing those signs.

Do not forget!

Much of our successes get lost for the lack of a little more. Again, this is Beatrice Ponce at WhyKeyBiscayne.com I want you to know that I take my profession very, very seriously. I make it my point and priority to be on the cutting edge of innovation, technology, as well as market trends, so I can serve my community and those that I’m trying to help. If you’re thinking about selling/Buying please give me a call or forward this video to somebody who might be thinking about buying or selling. Make it a great day!

Sources: Realtor.com