How will Miami Real Estate surf the Feds tightening during 2022? As of mid-March, the Feds are just initiating with Quantitative Tightening liquidity in the financial sector. In addition, the Feds also just stopped their Mortgage-backed securities buying program.

During the last two years, millions of people bought homes across the US, with very cheap interest on 30 years Mortgage loans. And millions of those who sold their homes in the first place migrated and bought homes with cash in cheaper cities, across the nation.

Miami real estate was among the markets that mostly benefited from this migration stampede. Homebuyers were motivated by lower taxes, cheaper & bigger houses, tropical weather, geographical location etc. But the stampede was, actually, ignited by the overwhelming political disparity the country is experiencing.

Around 75 well known financial firms, as well as, important corporate businesses such as Citadel, Blackstone, R&B Realty Group, Goldman Sachs, Microsoft, MRA Capital Partners have moved partial departments or complete headquarters to South Florida, particularly in the city of Miami. The same has happened in the new tech hub industry, as well as, the arts & design. All this translated into an enormous wave of relocation folks putting tremendous pressure on both home buying and rental markets.

Video: How will Miami Real Estate Surf the Feds tightening during 2022?

How will the Real Estate Market in Miami react with Liquidity Tightening Ahead of Us?

As the Feds stops buying mortgage backed securities and liquidity tightening ramps up, homes sales will start to slow down. Seventy five percent of homebuyers need a mortgage loan in order to buy a property.

Between the interest increase and the expected inflation, mortgage interest rates are expected to go all the way up to 6.5~7%. The home value across the nation has increased at record-highs. Today, most people will no longer meet the monthly payment requirements, and won’t qualify for a mortgage loan. Tons of properties will go back to the market as pending sales fail to close.

In addition, these measures will lead to a massive decrease on purchasing power or demand. It will reduce out of state cash buyers, as well as, all the trickle down effect of the quantitative ease policy and its impact on assest bubbles.

The higher interests will also drive away big Wall Street firms from real estate investment. They would have more attractive ways to allocate money without the implication and hassle of property management. Large inventory will comeback into the market, across the country.

It is important to understand that each city is a different market. The effects will be experimented with different time frames and intencity in each market. Even within each county and submarket, all the different products have different demands therefore some inventory gets more affected than others.

Last but not the least, the tendency is towards a market correction, but in the real economy there is no timing, any event or policy contingency can significantly impact the outcome or course.

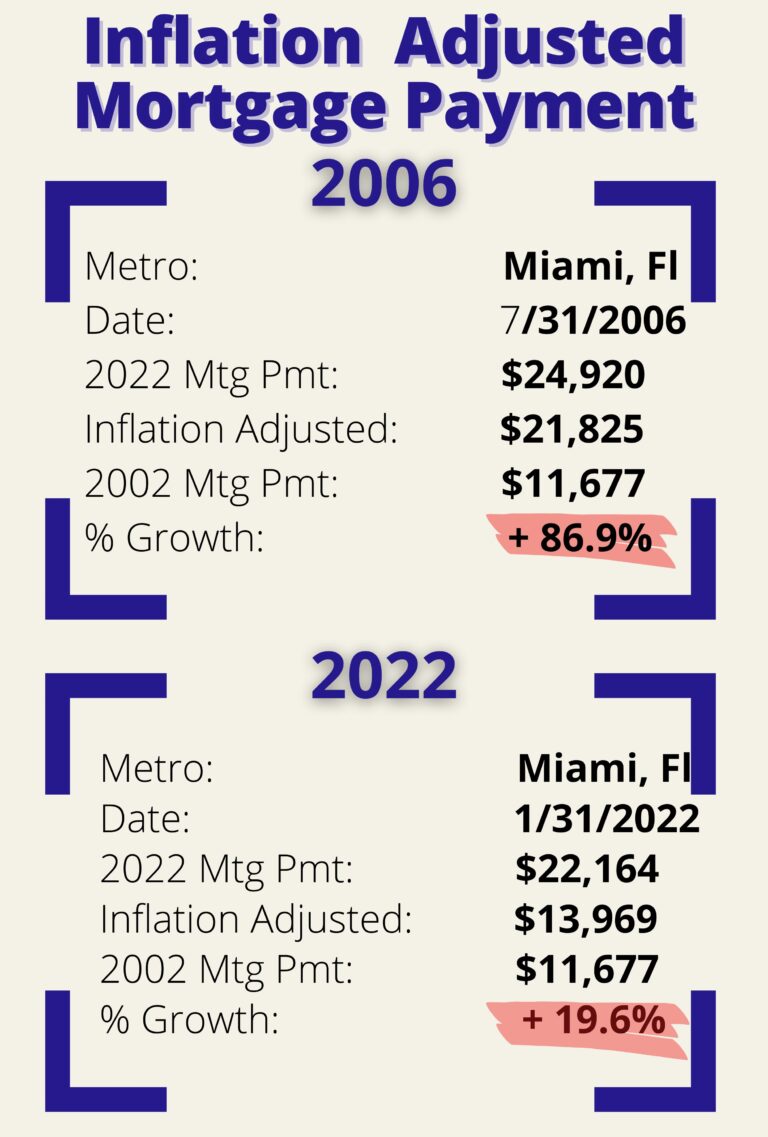

As for Miami, Fl when you look up its metric for Inflation-Adjusted Mortgage payments you can see the market is in a much better place than in 2006. Back then the ratio for inflation adjusted payment was +86.9% from the 2002 level, right before the market crash. Today, the rate is +19.6% from the 2002 level , which indicates the Miami real estate market is not as bubbly as it was on the last market crash.

Would Miami Housing market continue to rise?

If we look back at how the market slowed down during the last quantative tightening in 2018, you can predict that by the 3rd -4th quarter the market will definitely feel the effects and the market will slow down.

But this doesn’t mean prices will automatically plunge as it happened during 2018. Today’s market is very different, the domestic housing demand, in Miami, continues at an all time high. While Homes in Key Biscayne are closing with less than 3% discount from the listing price, most submarkets continue with 2 months worth of inventory.

Lastly, our South American buyer is back and will keep the market a float. South America is experiencing a new political leftist shift in countries as Peru, Chile,and possibly Colombia and Brasil. Realestate investment in Miami is a traditional way for South American to keep their wealth in dollars to avoid unstable policies and currencies.

Miami metro area has very little room for single-family homes new construction developments, the market relies on teardown and rebuilding. On the other side, new condo developments delivering during 2022-23 are sold out. Today, the new condo construction developments coming into the market will be delivered towards 2024, and with the high demand they are selling very fast. Miami new condo construction developments are then scheduled for 2026. Developers have not gone crazy with massive building as it happened during the 2006-2008 period.

In addition, during the last two years the Miami realestate market benefitted enormously with cash sales. This fact makes it a much stronger market during the next cycle ahead of us.

Within the high demand and the low inventory, I agree with Glenn Kelman, Refin’s CEO, when he commented “because inventory levels is so low, I don’t think there is going to be a significant step back in prices… we can see stable prices, reasonable home dying demand” the Miami Market will level up to a more balanced market. The upcoming anticipated recession might not have the same effects on the short or midterm, as the 2008 crisis.

I hope this information helps you with your real estate needs. you can always contact me for further details. And do not forget “Much of our successes get lost for the lack of a little more”. Beatrice Ponce from Coldwell Banker at WhyKeyBiscayne.com