Single-family home appreciation is a trending fact across most of the country. Zillow, Realtor.com and most market trend specialists consider Miami appreciation rates are among the highest in the country, at 5.03%, higher than 72.05% of the cities across the nation.

Five main factors influenced the real estate markets during 2020

- Low-interest rate

home sales soared at the beginning of the pandemic, - people were trying to escape larger cities with higher taxes as well as cities with long close-downs,

- resulting in a shortage of homes on the market

- Furthermore, new single-home developments and new condo construction had been very slow since the last construction cycle and financial crisis.

- Now, it is important to understand that the main factor that motivated buyers and sellers in today’s market has been the record low mortgage rates in combination with the other factors produced by the pandemic nervousness.

April 2021 has shown a slow down on sales, but until very recently, real estate markets in California, Phoenix as well as other markets all over the country had been manifesting 10-15 days absorption rate (or days on the market taking for properties to sell once they reach the market ), plus additionally, they were receiving multiple offers on the table pushing the prices up above the original listing price. Real estate experts are dealing with high numbers of buyers’ offers for the very small number of homes for sale in many areas around the country.

SINGLE-FAMILY HOME APPRECIATION IN KEY BISCAYNE, APRIL 2021

Before getting to the subject I want explain the following: Most market reports focus on median averages to estimate prices and percentage rates. I do not particularly agree with this method, averaging can lead to lots of confusion and misinterpretation for someone researching online and trying to understand the market of the property they are going to purchase. With todays technology buyers and sellers have access to do all research and even purchase or sell on their own. These online platforms with AI (artificial intelligence) solutions provide enough information to feel they can replace the expertise of a true realestate expert, or to create doubts about its performance. It is true that like in most industries, there are far more realtors that are there to make a sale rather than a service. But it is the homeowners’ and buyers’ job to research for the right expertise when they are selling or investing in their most precious investment or asset, are you looking for a quick sale or the right sale? Both are valid depending on your situation. Nevertheless, all this information produces additional effects and that is part of what I’d like to share with you, today, to help you learn or understand better how digitalization and the right content can help you.

A market has a lot of tiers or segments that need to be analyzed, and each one can perform differently. The offer, the demand, in addition to the economical trends and pressures, demographic and migration, plus the data and cycle, all play a role that needs to be evaluated. In other words, a particular segment within a market could be more active and perform more sales than another segment within the same market. With today’s economy, I strongly believe a standard CMA without a broad perspective can lead to the incorrect desicion-making. Especially in neighborhood with luxury market real estate like Key Biscayne.

Key Biscayne is small niche market but it includes condo units starting from a $200K+ price point all the way to $25M+ luxury single-family homes. Therefore, tier segmentation is critical and very decisive at the time of your desicion-making.

Learn & Understand Key Biscayne Real Estate Metrics

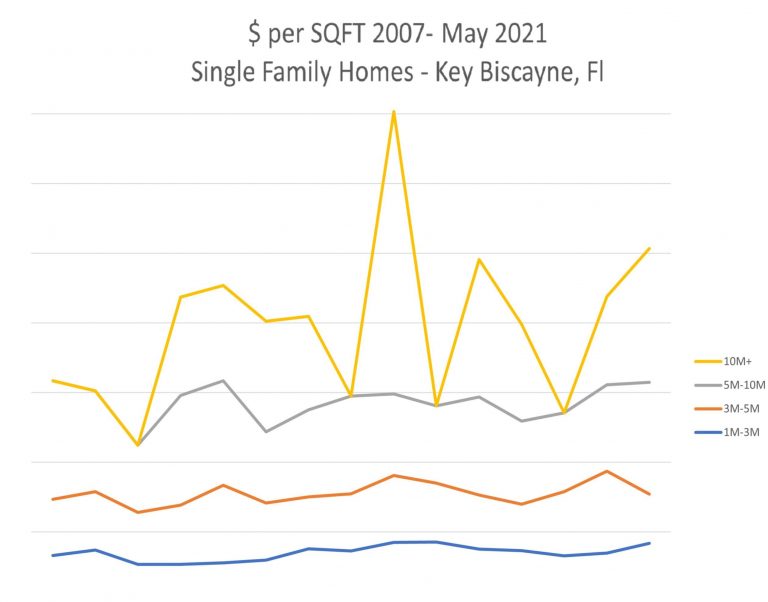

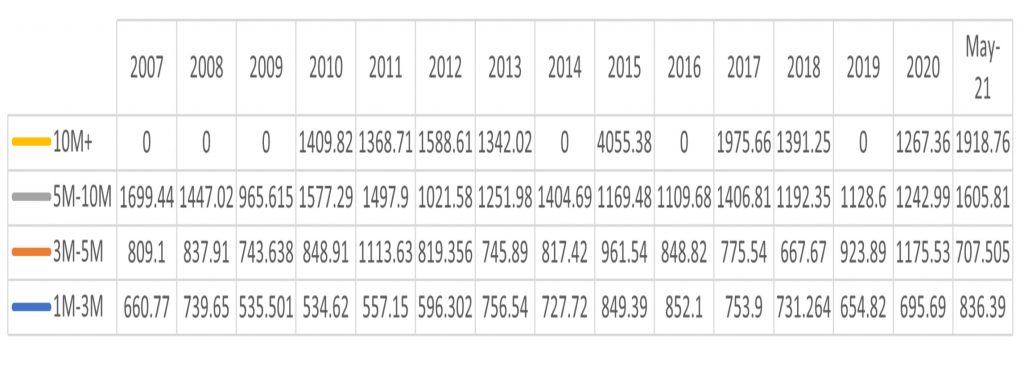

**This chart reflects the average price per square foot of Single-Family Homes in Key Biscayne during the last 13 years. The data for all properties sold from 2007 through May 2021, has been directly taken from the Miami Association of Realtors MLS. You can observe the performance of the average dollar price per square foot for every year.

Key Biscayne has aproximately 1100 single-family homes lots and around 250 waterfront properties. Originally Key Biscayne was a beach house second home market targeted to WWII veterans during the 1950s, throughout the years the most important transformation periods on the island have been when the Rickenbacker Causeway was built and when the island became incorporated as a new municipality in 1991. The bridge brought the attraction of many Miami local wealthy buyers moving and building fabulous homes followed by an entire community of wealthy winter birds and wealthy South Americans. Then, the incorporation of the Village brought many changes, especially the new building code enforcement, which leads to a long process of replacing the homes with brand new construction. Today, buyers from everywhere fall in love with the lifestyle the island provides. They come looking to settle and raise their family in this small beach lifestyle community located only 5 miles or 15 min away from the City of Miami.

In the above chart, you can appreciate the price behavior of single-family homes throughout the last then fifteen years. The 2007-2009 period is added for a better insight on how the market has picked and gone down. You can also see how each segment behaves differently and ultimately, how the prices correct themselves and go back up.

The following exercise is to help Key Biscayne homeowners understand the importance of correcting the selling price on time.

$10M+

If you look at the graph you can appreciate how 10M+ homes peaked in 2015 and then slowly readjusted. It was the year the exclusive former Matheson estate sold for $47M at $4,052 per square foot. In adition, most of these luxury homes are new waterfront constructions with a prime location over the Biscayne Bay, Hurricane Harbor or Pine Canal.

During 2020, three properties sold at an average $1267.36 per square foot and at a discount price between 28%-38% from their original listing price. And this year two properties have closed at an average $1918.76 per square foot and at a discount price between 18%-21% from their original listing price.

$5M-$10M

On this other segment, 12 homes sold during 2020, at an average of $1242.99 per square foot. The discounts are slightly different, 4 sales closed between 40-50% discount from its original listing price trying to sell for several years without properly correcting its value offers to end selling under the purchasing cost. Another 4 sold between 20% discount which is a more reasonable correction time and only 4 sold at 10-15% discount.

Now during this year, 4 homes have sold at an average of $1605.81. One property sold at a discount of 38% from its original listing price with over 6 years on the market, now the other 3 properties sold with discounts between 15%-26% of their original listing price.

$3M-$5M

$1M-$3M

The Pro’s & Con’s of keeping a Property Listed for a Long Period of Time.

- The property keeps exposed to potential buyers

- The property price is re-adjusted according to the market

- Having a property too long on the market produces a negative effect on the potential buyer.

- Zillow and all online platform show the price reduction on its history, it is a public data.

- It leads in bigger reduction on price.

Did Key Biscayne Homes Appreciated?

If you look at the 15 years chart averaged metric you could see the single-family homes appreciation behavior is not a straight line. The $5M-10M is showing a 6% appreciation and the $1-2M is of 21%.

The real answer is individualized as it depends when was the purchase done. If you bought a $5M-10M home in 2012 which averaged $1021.58 and today is averaging $1605.81 your value could have gone up to 37%. But if you bought a home between $3M-5M in 2011 your value decreased up to 37%. The real key is understanding your longterm investment to better know when is the right time to sell within the economic cycle.

Today's Market Place

In the last two quarters when you compare Key Biscayne real estate to other markets, Key Biscayne single-family homes has not experimented multiple-offers battlegrounds closings above listing price. During this low-inventory period the last two quarters, newly listed homes have up to 5-8% reduction price. Today there are 30 active homes in the market, a third of the 120 homes that were active for sale continuously during the last 3 years.

Can the market experience multiple-offer scenarios as other markets? it is something we should not discard, besides the 30 actives homes for sale there are 32 other homes pending to close and 9 others with contracts. Nevertheless, there other factors and unanswered questions that need to be monitored as for example the additional requests banks are adding for financing. As all state’s economies open, will the internal migration continue? Or will the international buyers be motivated to invest as the dollar gets affected.

At this time we are still going through the effects of the pandemic, most economies are just about to re-open in Europe while South America is mostly shut down. In the meantime the US, is already feeling the effects of most economic measures taken by the Federal Reserve and comercial banks, I believe it is too soon to consider the storm is over.

Real estate will react according to the economy and the measures taken. Are the Feds going to raise the rates soon? will the quantitative easing continue? Will the dollar debilitate? and how about the mortgage moratorium and the non-eviction mandate? These are the things you need to follow in order to know better how the market will react.

Nonetheless, for Key Biscayne, it has been a very positive period. It has allowed the single-home property market to correct its pricing and have a healthier marketplace for sellers and buyers as a whole.

As I work on my market report for 3rd & 4th quarter, I will include the condo market and by then we will have a lot of the above questions answered and a much better forecast of Key Biscayne market.

If you like the content you are reading I invite you to subscribe here for my newsletter or follow @whykeybiscayne at your favorite social media. If you have any questions related to Real Estate or would like a special analysis of your property feel free to contact me at anytime.