4 things to expect for US real estate 2022, it is key to keep well informed when a financial storm seems inevitable.

Most media outlets swamp the headlines with catastrophic news. And when you try to research experts’ opinions they all come across with a different view. In the end, the puzzle becomes overwhelming, and that is when most of our mistakes take place.

Goldman Sachs predicts a 16% growth, Freddie Mac a 7%, Fannie Mai a 7.9% Redfin a 3%, and Corelogic a 1.9% all their models share an increase in growth with the exception of Mortgage Banker Asociation is showing 2.5% decrease for 2022. They are all using a different interest rate for their predictions.

When confusion gets in the way, I like to go focus on the key facts to help me get better decisions. And for that I bring you, 4 things to expect in the US real estate in 2022:

4 Key Points for US Real Estate 2022.

1. Federal Reserve reversing their pandemic economic policy

These policies led to a massive home buying spree, plus the stock market skyrocketing, and now we are dealing with a record 7% inflation spike, as a result of the excessive QE & all the rest of the tools.

By March this year liquidity will be reduced and interest will start to rise. Now, according to some very respected economists that I follow, the real estate market will actually feel the impact and start to see a slow down once interests get between 3.75% to 4%.

So far, the Feds have announced 3 rate increases by fall of 2022 up to 3.50%. If their plan works smoothly the real estate might not get as disrupted during 2022. An increase in yields doesn’t mean you cannot buy a home, it just means the rules are different.

2-Market correction versus Inflation

Today inflation is at 7%, 3 times the 2% policy of last decade. Some experts claimed this inflation is the result of the economic lockdowns that disrupted production and supply chains. Other experts point out directly to the Feds 10-year long term excessive QE more commonly referred to as Printing Money or bails outs, as the main reason.

The Feds put themselves at a crossroad: they either protect the Stock Market and credit market with their QE and the rest of the economic tools. Or they actually do commit this time to raise interest and let the corrections of markets take place. They can also put in place some corrections and then come back with more QE and the rest of the tools before the market collapses. This mechanism of stepping in and out has been a trend to keep the economy from a major crash during the last decade.

Let’s be clear, allowing a full correction and letting the businesses close down or letting people lose their jobs and homes is as bad as the cost of inflation. This is an electoral year, I believe they will try their best to avoid a major crash, as some predict. The situation is both economical and political.

Now, I recommend keeping the real focus on the second quarter to actually foresee the effects on real estate and on the rest of the economy.

3-Low Housing Inventory & Massive Construction Surge

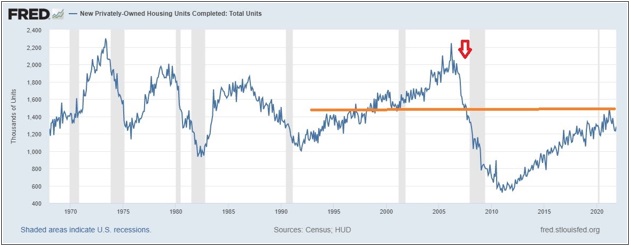

The housing inventory got depleted during 2020, developers had been a lot more cautious during the last decade after the 2008 housing crash. Back in mid- 2019 much prior to the pandemic, Graig Studnicky CEO & founder of ISG World Related explained at their yearly summit how the lack of new construction would affect the market during the next 3-5 years, the resale market would be the only product to fulfill the demand. if you see the following chart, you can appreciate we are at the same levels as the early 2000s, when it comes to inventory.

The housing inventory got depleted during 2020, developers had been a lot more cautious during the last decade after the 2008 housing crash. Back in mid- 2019 much prior to the pandemic, Graig Studnicky CEO & founder of ISG World Related explained at their yearly summit how the lack of new construction would affect the market during the next 3-5 years, the resale market would be the only product to fulfill the demand. if you see the following chart, you can appreciate we are at the same levels as the early 2000s, when it comes to inventory.

NAR the National Association of Realtors has recently said, the US needs from 4-5M homes to ease the housing crises, they estimate the process could take 7-10 years. Additionally, the US Census published there were a total of 1,471.100 building permits requested during 2020-2021, some of these projects sold out at pre-selling, and very few will be delivered during 22. Now we are expecting to see lots of delays and much higher prices for these new constructions due to lack of labor, shortage, and supply cost at a much higher price.

I do not agree with the massive foreclosures that everyone is waiting for, the forbearance plan has somehow helped a lot of these owners, most of these owners had a lot of equity on their homes so they were not going lose it, this is a very different crisis from 2008-09. The inventory that will foreclose will be absorbed by the actual demand.

The real problem as this lack of housing inventory persists is in rents going even higher. I do believe you have to be careful on how high to go before affordability becomes another issue, there is so much a landlord can raise rents when local jobs do not make the numbers. I would suggest you research well the average income in your city before considering going higher and higher on your rentals. Affordability can push people to move back with parents or with roommates and lead to vacancy rates spikes.

4-Demographic & migration

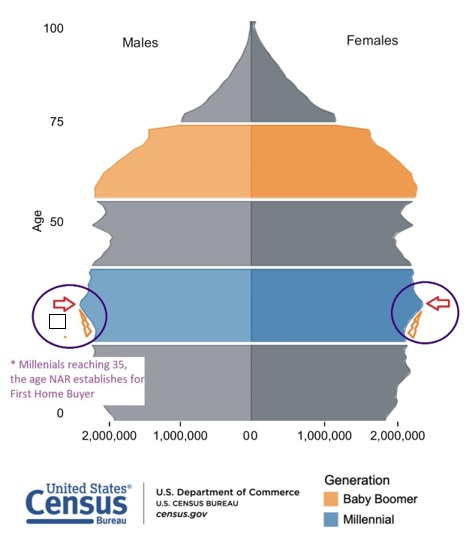

According to the US Census out of the 78 Million millennials, a large portion has reached 35, which is the age range estimated for first home buyers. Now let’s remember the 2008 crisis pushed millennials to move in with their parents and they saved a lot of money. With the pandemic a lot of millennials got motivated and purchased a home, on the other hand, a lot of generation X retired earlier, sold their homes, and relocated to cheaper states. Then we have our foreign nationals investor that has not really been able to come,

with the lockdowns, there have been fewer foreign buyers but as economies open up we will see have them back. And our second home buyer, that is investing in vacation homes just to have another choice where to go and not to be locked again.

So, the demand for housing is there, there is no indication that that is going to change during 2022.

Now, the migration from northern states to southern states was accelerated by the pandemic but not created by it. People from heavily taxed states were already looking for cheaper alternatives. Florida received 50K domestic movers between 2017-2019 prior to the pandemic and 211,196 domestic movers between 2020-2021.

Now during 2022, as some cities’ home prices escalated to all-time highs, migration could start focusing on other cities with more affordable housing. Affordability will be a stronger issue in 2022. With the exception of Florida which will remain at the top list as the #1 state for homebuyers, we could see homebuyers shifting and start looking into other cities for a cheaper cost of living.

Video: 4 things to expect for US real estate 2022

If you find this information useful you can subscribe here to the blog and receive my quarter real estate market review. You can also contact me , I am here to help you.

Do not forget! “Much of our successes get lost for the lack of a little more”. Again, this is Beatrice Ponce from at WhyKeyBiscayne.com